On Balance: When All Lives Matter Equally: Equity Weights for BCA by Combining the Economics of VSL and US Policy

If the Value of a Statistical Life (VSL) is observed to be a function of income and policy fixes VSL as a constant, then policy has defined welfare weights over income.

If the Value of a Statistical Life (VSL) is observed to be a function of income and policy fixes VSL as a constant, then policy has defined welfare weights over income.

Few topics are as controversial between the public and benefit-cost analysts as placing a value on a statistically lost or shortened life, the VSL. Recent public discourse and civil unrest are in part driven by whether some classes of lives matter more than others. Yet with the dry logic of economists it is possible to combine evidence based VSLs that change with income, the less money you have the lower the VSL, with the public policy VSL that is chosen to be constant.

How can these both be true, that observed VSL changes with income and yet VSL is constant for policy within the United States? The contradiction is resolved if implicit weights are applied to individuals’ valuations in a way to hold the VSL constant. In short, a policy choice about constant VSL is an implied but official statement about welfare weights for a prominent outcome and potentially for all types of outcomes that vary with income.

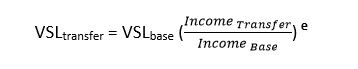

Begin with evidence based VSLs. There is a decades long practice of adjusting VSLs for income differences based on economist’s empirical research. Estimates of the elasticity of the VSL with respect to income (e) has been used to transform a base VSL into a new VSL when incomes of the two groups are known. There are of course caveats to doing so but the standard equation takes the form of:

Applications of such transfer VSLs for countries with differing income levels or for differing income groups within a country have often used the US policy VSL as the base. Any difference in income for a group can generate differences in the estimated VSLs. Such transfers could also be calculated for such controversial comparisons as: a) lower income states compared to higher income states, b) lower income Black or Hispanic households compared to higher income White households, c) for lower income female head of households compared to higher income male head of households, and so on.

Why aren’t such VSL transfer estimates done? First, doing so can cause some unease when one implies, correctly when based on evidence, that the lower income group on average is not willing to pay as much to reduce the risk of mortality as a higher income group. But secondly, public policy has explicitly refrained from using differing VSLs in the United States, at least for regulatory purposes in at least four major agencies. For instance, the EPA Economic Guidelines state “EPA policy is to apply a single VSL estimate for the calculation of benefits of mortality risk reductions experienced by all affected populations associated with all EPA programs and policies.” The Departments of Transportation, Homeland Security, and Health and Human Services similarly use a fixed value. And a final political economy reason for a constant VSL in these days where “all lives matter”-- it is hard to imagine a politician or bureaucrat valuing the statistical equivalent of a life in a lower income group less than that of a higher income group.

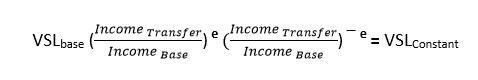

Adding another term to Equation 1, a social welfare weight that varies by income, can rationalize varying VSLs with a constant policy VSL:

The second bracketed term is the welfare weight that restores an income varying VSL to a constant VSL. It is a specific case of the welfare weight being the inverse of the original income function.

So economic observation combined with a policy decision implies a welfare weight. What form is the weight in this standard VSL practice? Formally, it is observationally equivalent to an Atkinson weight relative to the income base that has been suggested for use in distributionally weighted benefit-cost analysis (BCA). The key parameter is e, the elasticity of the VSL with respect to income that becomes the “priority” parameter of the Atkinson welfare function.

The welfare weight could be used in ways both limited and general. The most limited way allows BCAs to use income varying VSLs, and then use the welfare weights defined above only on statistical mortality estimates. This is equivalent to using a constant policy VSL but separates the positive and the normative (policy) steps. Or the current practice of using a policy constant VSL could be applied directly with a notation that it is implicitly applying a welfare weight.

More broadly, analysts could apply the now revealed welfare weight to other impacts. Other health outcomes might be considered proximate candidates on the assumption that the income elasticity of the VSL applies to all health impacts. Finally, analysts could apply the welfare weights to any and all benefits or costs that vary across US income classes. This broad approach might be justified given the salience of policy interest and research in the VSL that like a good precedent reveals a clear societal value. This latter use of weights might be most valuable as a sensitivity analysis to a standard, unweighted BCA.

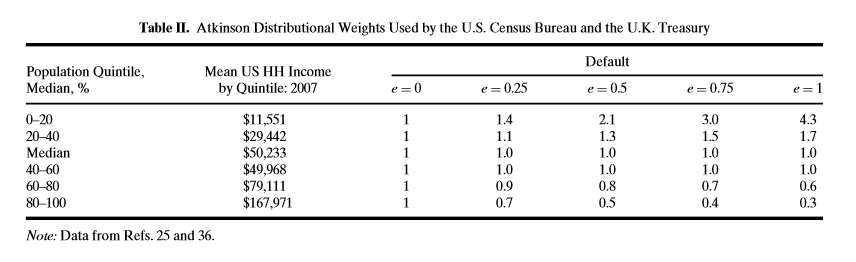

Would welfare weighting using the VSL elasticity potentially change BCA based decisions if impacts differ significantly across income groups? First, consider that the elasticities themselves have the potential to change with income, but for the United States e is often estimated to be about .5, conveniently in the mid-range of values suggested for broad based welfare weights. What does this imply for BCA weighting? I spelled this out in an earlier publication with differing values of e, including the BCA default of e being 0, and applied them to the different quantiles of the mean US household income.

For a value of e equal to .5 and using earlier US income distribution data, benefits or costs to people in the lowest quintile would be multiplied by a value of 2.1; those in the middle quintile would be the norm weighted at 1; while benefits or costs to the upper quintile would receive a weight of .5; about twenty-five percent of the weight given to those in the lower quintile and half those in the middle.

Welfare weights can have other dimensions. If VSL is also a function of age and policy holds the VSL constant across age, then implied age weighting exists. And there are decisions where US policy does not appear to put equal value on mortality risk such as those affecting foreigners.

Welfare weights are now hiding in plain sight. Decades of economic research and US agency policy commitment to a single VSL give us welfare weights that vary by income for benefit-cost analysis. While these results hold most directly for estimated mortality and health, they could also be applied to all benefit or cost impacts that vary by income within the US.

Appreciation is extended to Matt Adler, James Hammitt, David Weimer and two anonymous referees for comments.

Selected References

Adler, M., 2019. Measuring Social Welfare: An Introduction. Oxford University Press, New York, NY.

Farrow, S., 2011. Incorporating Equity in Regulatory and Benefit-Cost Analysis Using Risk Based Preferences, Risk Analysis, 31(6):902-907.

Hammitt, J. and L. Robinson, 2011. The Income Elasticity of the Value per Statistical Life: Transferring Estimates between High- and Low-Income Populations. Journal of Benefit-Cost Analysis, 2(1)1.

Somanathan, E., 2006. Valuing Lives Equally: Distributional Weights for Welfare Analysis. Economics Letters, 90, p. 122-125.

Viscusi, W. K. and C. Masterman, 2017. Income Elasticities and Global Values of a Statistical Life. Journal of Benefit-Cost Analysis, 8(2):226-250.